SELECT AN INVESTMENT STRATEGY

I prefer that someone else manage the investment.

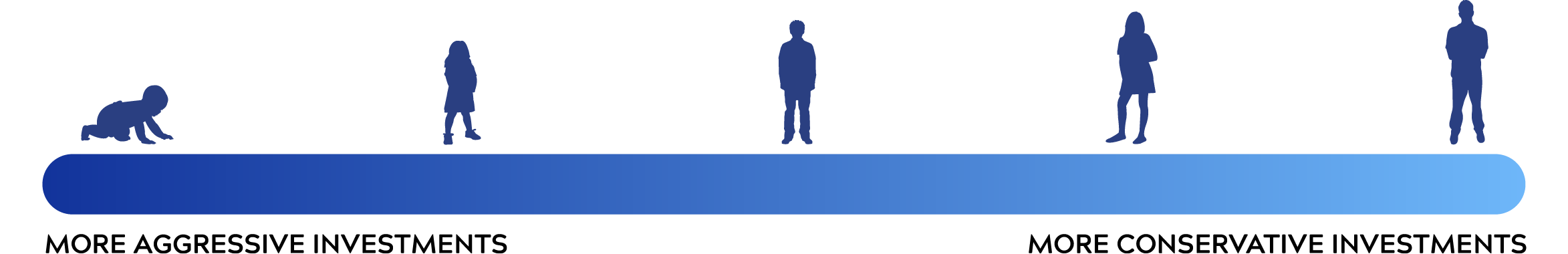

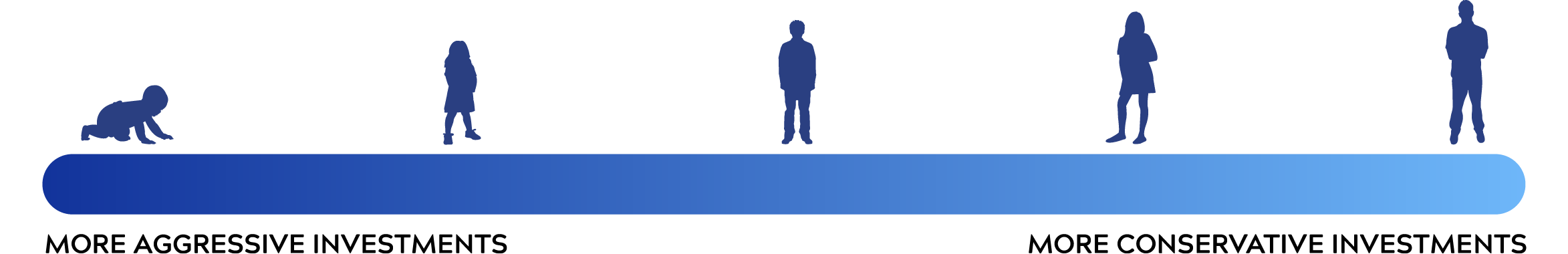

A professionally designed portfolio that automatically adjusts risk levels, from more aggressive to more conservative, as your child ages.

A smart & easy path to college savings

Professionally designed investment portfolio

Automatically becomes more conservative as your child nears college enrollment

I prefer predesigned portfolios.

The Enrollment Year Portfolio + six portfolios with static investment allocations focused on specific investment objectives.

Choose one or more predesigned and diversified portfolio options

Primarily passive professionally designed static portfolios

Portfolio options available to fit your desired investment strategy (growth, income, blended and enrollment year based)

I prefer to customize my investment strategies.

All portfolios + a wide range of individual fund options across the risk/return spectrum.

Build your own portfolio from a wide variety of investment options

Managed by proven investment managers such as Blackrock, DFA, Eaton Vance and Vanguard

Includes specialty options such as a Social Index Fund

We’ll Handle the Portfolio Customization

The Enrollment Year Portfolio

NEW LOWER FEES

0.05% - 0.10% (5-10 bps)BENCHMARK

Weighted on pro-rata share of benchmarks for included Asset ClassesMulti-Manager Growth Portfolio

conservative

moderate

aggressive

ANNUAL FEE

0.19% (19 bps)BENCHMARK

Weighted on pro-rata share of benchmarks for included Asset ClassesMulti-Manager Blended Portfolio

conservative

moderate

aggressive

ANNUAL FEE

0.13% (13 bps)BENCHMARK

Weighted on pro-rata share of benchmarks for included Asset ClassesMulti-Manager Income Portfolio

conservative

moderate

aggressive

ANNUAL FEE

0.13% (13 bps)BENCHMARK

Weighted on pro-rata share of benchmarks for included Asset ClassesPassive Growth Portfolio

conservative

moderate

aggressive

ANNUAL FEE

0.06% (6 bps)BENCHMARK

Weighted on pro-rata share of benchmarks for included Asset ClassesPassive Blended Portfolio

conservative

moderate

aggressive

ANNUAL FEE

0.05% (5 bps)BENCHMARK

Weighted on pro-rata share of benchmarks for included Asset ClassesPassive Income Portfolio

conservative

moderate

aggressive

ANNUAL FEE

0.06% (6 bps)BENCHMARK

Weighted on pro-rata share of benchmarks for included Asset ClassesMoney Market Fund

conservative

moderate

aggressive

Manager

Florida PrimeAnnual Fee

0.04% (4bps)Benchmark

Merrill Lynch 91 day T BillTicker

Exclusive (Fund not publicly available)Core Plus Fixed Income Fund

conservative

moderate

aggressive

Manager

WellingtonAnnual Fee

0.22% (22 bps)Benchmark

Bloomberg Barclays AggregateTicker

Exclusive (Fund not publicly available)Core Fixed Income Fund

conservative

moderate

aggressive

Manager

VanguardAnnual Fee

0.03% (3 bps)Benchmark

Bloomberg Barclays AggregateTicker

VBMPXHigh Yield Fund

conservative

moderate

aggressive

Manager

VanguardAnnual Fee

0.12% (12 bps)Benchmark

95% Bloomberg Barclays U.S. High-Yield Ba/B 2% Issuer Capped Index and 5% Bloomberg Barclays U.S. 1–5 Year Treasury Bond IndexTicker

VWEAXEmerging Markets Index Fund

conservative

moderate

aggressive

Manager

VanguardAnnual Fee

0.18% (18 bps)Benchmark

Bloomberg Barclays U.S. Dollar Emerging Markets Government RIC Capped IndexTicker

VGIVXBank Loans Fund

conservative

moderate

aggressive

Manager

Eaton VanceAnnual Fee

0.77% (77 bps)Benchmark

S&P/LSTA Leveraged Loan IndexTicker

EIBLXTreasury Inflation-Protected Securities (TIPS) Index Fund

conservative

moderate

aggressive

Manager

VanguardAnnual Fee

0.04% (4 bps)Benchmark

Bloomberg Barclays U.S. 0-5 Year TIPS IndexTicker

VTSPXU.S. Broad All Cap Index Fund

conservative

moderate

aggressive

Manager

VanguardAnnual Fee

0.02% (2 bps)Benchmark

CRSP US Total Market IndexTicker

VSMPXU.S. Large Cap Equity Index Fund

conservative

moderate

aggressive

Manager

VanguardAnnual Fee

0.02% (2 bps)Benchmark

S&P 500 IndexTicker

VIIIXSmall/Mid Cap Equity Index Fund

conservative

moderate

aggressive

Manager

VanguardAnnual Fee

0.05% (5 bps)Benchmark

S&P Completion IndexTicker

VIEIXDeveloped International Equity Fund

conservative

moderate

aggressive

Manager

BlackrockAnnual Fee

0.45% (45 bps)Benchmark

MSCI EAFE IndexTicker

BROKXTotal International Index Fund

conservative

moderate

aggressive

Manager

VanguardAnnual Fee

0.08% (8 bps)Benchmark

FTSE Global All Cap ex US IndexTicker

VTPSXGlobal Equity Fund

conservative

moderate

aggressive

Manager

DFAAnnual Fee

0.25% (25 bps)Benchmark

MSCI All Country World IndexTicker

DGEIXReal Estate Index Fund

conservative

moderate

aggressive

Manager

VanguardAnnual Fee

0.13% (13 bps)Benchmark

MSCI US Investable Market Real Estate IndexTicker

VGSLXExplore your investment options by selecting from the choices below

for comparison view, view page on a tablet or larger screen.

Are you ready to start saving?

Open a Florida 529 Savings Plan at any time.

Enroll Today Download Investment Options WorksheetFrequently Asked Investment Questions

Frequently Asked Investment Questions

Frequently Asked Investment Questions

Enrollment Year Portfolio

NEW LOWER FEES

0.05% - 0.10% (5-10 bps)BENCHMARK

Weighted on pro-rata share of benchmarks for included Asset Classes

Static Portfolios

Multi-Manager Growth Portfolio

ANNUAL FEE

0.19% (19 bps)BENCHMARK

Weighted on pro-rata share of benchmarks for included Asset Classesconservative

moderate

aggressive

Multi-Manager Blended Portfolio

ANNUAL FEE

0.17% (17 bps)BENCHMARK

Weighted on pro-rata share of benchmarks for included Asset Classesconservative

moderate

aggressive

Multi-Manager Income Portfolio

ANNUAL FEE

0.21% (21 bps)BENCHMARK

Weighted on pro-rata share of benchmarks for included Asset Classesconservative

moderate

aggressive

Passive Growth Portfolio

ANNUAL FEE

0.06% (6 bps)BENCHMARK

Weighted on pro-rata share of benchmarks for included Asset Classesconservative

moderate

aggressive

Passive Blended Portfolio

ANNUAL FEE

0.05% (5 bps)BENCHMARK

Weighted on pro-rata share of benchmarks for included Asset Classesconservative

moderate

aggressive

Passive Income Portfolio

ANNUAL FEE

0.07% (7 bps)BENCHMARK

Weighted on pro-rata share of benchmarks for included Asset Classesconservative

moderate

aggressive

Individual Fund Options

CASH OPTION

CASH OPTION FIXED INCOME

FIXED INCOME EQUITY

EQUITY SPECIALTY

SPECIALTYMoney Market Fund

Manager

Florida PrimeAnnual Fee

0.04% (4bps)Benchmark

Merrill Lynch 91 day T BillTicker

Exclusive (Fund not publicly available)conservative

moderate

aggressive

Core Plus Fixed Income Fund

Manager

WellingtonAnnual Fee

0.22% (22 bps)Benchmark

Bloomberg Barclays AggregateTicker

Exclusive (Fund not publicly available)conservative

moderate

aggressive

Core Fixed Income Fund

Manager

VanguardAnnual Fee

0.03% (3 bps)Benchmark

Bloomberg Barclays AggregateTicker

VBMPXconservative

moderate

aggressive

High Yield Fund

Manager

VanguardAnnual Fee

0.12% (12 bps)Benchmark

95% Bloomberg Barclays U.S. High-Yield Ba/B 2% Issuer Capped Index and 5% Bloomberg Barclays U.S. 1–5 Year Treasury Bond IndexTicker

VWEAXconservative

moderate

aggressive

Emerging Markets Index Fund

Manager

VanguardAnnual Fee

0.23% (23 bps)Benchmark

Bloomberg Barclays U.S. Dollar Emerging Markets Government RIC Capped IndexTicker

VGIVXconservative

moderate

aggressive

Bank Loans Fund

Manager

Eaton VanceAnnual Fee

0.77% (77 bps)Benchmark

S&P/LSTA Leveraged Loan IndexTicker

EIBLXconservative

moderate

aggressive

Treasury Inflation-Protected Securities (TIPS) Index Fund

Manager

VanguardAnnual Fee

0.04% (4 bpsBenchmark

Bloomberg Barclays U.S. 0-5 Year TIPS IndexTicker

VTSPXconservative

moderate

aggressive

U.S. Broad All Cap Index Fund

Manager

VanguardAnnual Fee

0.02% (2 bps)Benchmark

CRSP US Total Market IndexTicker

VSMPXconservative

moderate

aggressive

U.S. Large Cap Equity Index Fund

Manager

VanguardAnnual Fee

0.02% (2 bps)Benchmark

S&P 500 IndexTicker

VIIIXconservative

moderate

aggressive

Small/Mid Cap Equity Index Fund

Manager

VanguardAnnual Fee

0.05% (5 bps)Benchmark

S&P Completion IndexTicker

VIEIXconservative

moderate

aggressive

Developed International Equity Fund

Manager

BlackrockAnnual Fee

0.45% (45 bps)Benchmark

MSCI EAFE IndexTicker

BROKXconservative

moderate

aggressive

Total International Index Fund

Manager

VanguardAnnual Fee

0.08% (8 bps)Benchmark

FTSE Global All Cap ex US IndexTicker

VTPSXconservative

moderate

aggressive

Global Equity Fund

Manager

DFAAnnual Fee

0.25% (25 bps)Benchmark

MSCI All Country World IndexTicker

DGEIXconservative

moderate

aggressive

Social Index Fund

Manager

VanguardAnnual Fee

0.14% (14 bps)Benchmark

FTSE4Good US Select IndexTicker

VFTAXReal Estate Index Fund

Manager

VanguardAnnual Fee

0.13% (13 bps)Benchmark

MSCI US Investable Market Real Estate IndexTicker

VGSLXconservative

moderate

aggressive